Xbox Game Pass has cemented its place as a dominant force in the video game subscription landscape, offering a vast library of titles for a monthly fee. Its success in attracting millions of subscribers is clear, often highlighted by Microsoft as a key driver of their gaming ecosystem growth. However, questions regarding the service`s actual profitability at a corporate level persist, particularly when considering the immense investment required to fuel it with new, high-profile content.

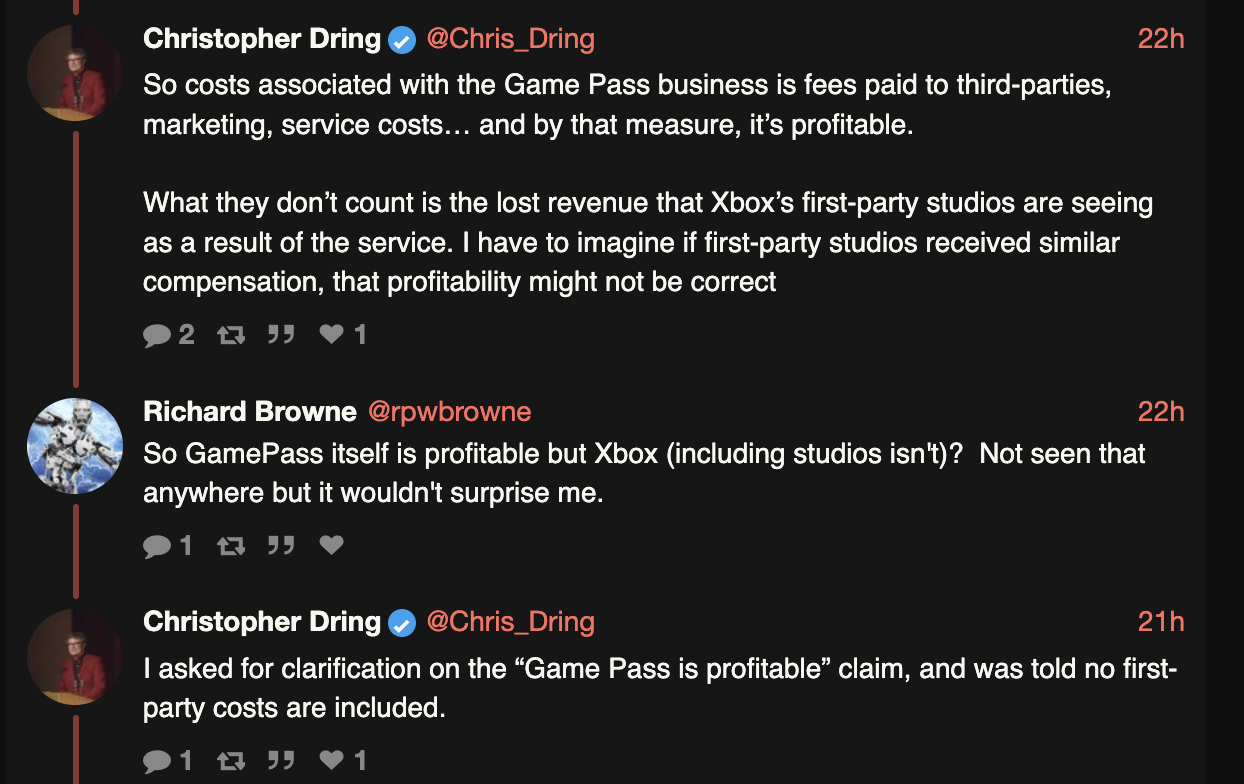

Adding to this discussion, Chris Dring, a prominent journalist and head of GamesIndustry.biz, recently shared observations suggesting that the reported profitability of Game Pass might be viewed through a specific, perhaps incomplete, financial lens. According to insights he claims to have received directly from Xbox representatives, Microsoft`s internal calculations for Game Pass profitability reportedly encompass various operational expenses, such as payouts to third-party developers whose games appear on the service, marketing efforts, and the technical costs associated with maintaining the service infrastructure.

However, the crucial element reportedly excluded from these Game Pass-specific profitability assessments is the staggering cost of developing Xbox`s own exclusive first-party titles. This distinction is significant. Creating a modern, AAA video game can require hundreds of millions of dollars in development and marketing costs. When such a title is then launched directly onto Game Pass on day one, its creation cost represents a massive investment primarily aimed at driving value and subscriptions for the service.

The example of Starfield serves as a pertinent illustration. Bethesda`s expansive role-playing game was reportedly one of the most expensive projects undertaken by Microsoft post-acquisition, with estimates suggesting costs potentially reaching $400 million or more. Starfield debuted immediately on Game Pass, successfully attracting a significant player base – Bethesda reported 15 million players by December 2024. Yet, precisely how many of those players actively purchased the game outright versus accessing it solely through their Game Pass subscription remains undisclosed. Without this clarity, the game`s contribution to traditional sales revenue versus its role purely as a Game Pass draw is obscured.

This lack of detailed financial breakdowns is characteristic of Microsoft`s reporting on Game Pass. While subscriber numbers and overall engagement are often shared, granular data on how individual flagship titles perform financially *within* the Game Pass model – specifically, the balance between their immense development cost and the revenue/subscriber growth they stimulate – is not made public. This accounting approach, while valid from a certain perspective, offers a distinct view of the service`s performance separate from the overall significant investment required to supply its most compelling content.

Ultimately, while Game Pass undoubtedly contributes to building the Xbox ecosystem and driving player engagement, the question of whether the *entire* first-party strategy, encompassing both the subscription revenue and the multi-hundred-million-dollar content creation budget, is traditionally profitable remains a subject of expert debate, residing largely behind the corporate curtain of specific financial reporting methods.